Blockchain data analysts from Nansen have revisited the days leading up to the collapse of FTX, including the transfer of $4.1 billion worth of FTT tokens between the exchange and Alameda Research.

A Nansen report shared with Cointelegraph reveals unique observations from the blockchain analytics firm, highlighting the close relationship between the two companies founded by Sam Bankman-Fried as the former FTX CEO appears in court to face a litany of charges relating to the collapse of the exchange.

The collapse of FTX is widely reported to have been sparked by initial reports that flagged the significant 40% share of Alameda’s $14.6 billion in assets held in FTT tokens in September 2022.

Nansen analysts revealed that they had observed dubious on-chain interactions between FTX and Alameda before these reports came to light. Between Sept. 28 and Nov. 1, Alameda sent $4.1 billion FTT tokens to FTX and several continuous transfers of United States dollar-pegged stablecoins amounting to $388 million.

On-chain data also indicated that FTX held around 280 million FTT tokens (80%) of the total 350 million FTT supply. Blockchain data reflects “considerable” proportions of FTT trading volume amounting to billions of dollars flowing between various FTX and Alameda wallets.

Nansen also highlights that most of the FTT token supply, consisting of company tokens and unsold non-company tokens, was locked in a three-year vesting contract. The lone beneficiary of the contract is an Alameda-controlled wallet, according to the analysts.

Given that the two companies controlled around 90% of the FTT token supply, Nansen suggests that the entities were able to prop up each other’s balance sheets.

The report also suggests that Alameda most likely sold FTT tokens over-the-counter, as well as for collateral for loans from cryptocurrency lending firms.

“This theory is backed by historical on-chain data where we observed regular large inflows and outflows between FTX, Alameda and Genesis Trading wallets with transfer volumes up to $1.7 billion as seen in Dec 2021.”

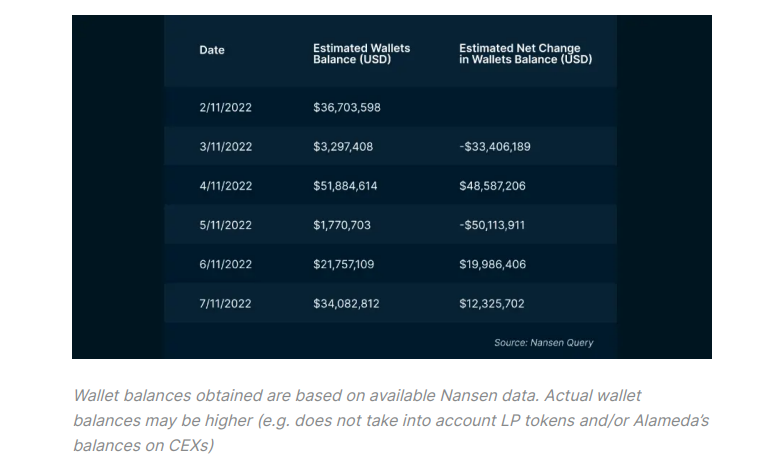

The collapse of the Terra ecosystem and subsequent bankruptcy of Three Arrows Capital (3AC) likely led to liquidity issues for Alameda due to the drop in value of FTT, which led to a covert, $4 billion FTT-backed loan from FTX.

“Our on-chain data indicates that this may have happened. Amidst the collapse of 3AC in mid-June 2022, Alameda sent ~163m of FTT to FTX wallets, worth ~$4b at that time.”

The researchers claim that the $4 billion transaction volume coincided with a $4 billion loan figure that close associates of Bankman-Fried had divulged in an interview with Reuters.

Blockchain data also reflects how Alameda would not have been able to make good on an offer to buy FTT tokens from Binance at $22 on Nov. 6. This was after Binance CEO Changpeng Zhao announced that the exchange would offload its tokens following disparaging reports about Alameda’s balance sheet.

Magazine: Blockchain detectives: Mt. Gox collapse saw birth of Chainalysis

Source: Coin Telegraph